Finding an appropriate position in the sand on where to

draw the line to find a starting point has been one of the

most difficult areas to establish in this frustratingly complex

jigsaw puzzle . . .

Unearthing the locations of the estates originally held by the

Chennells in England (and presumably still owned by their

descendants) has been fraught with solid brick walls put up

mainly by unhelpful bureaucrats.

There seemed to be very little written information from which to gather the necessary facts.

Almost all these so-called facts are hidden deeply in wills and secret or half secret trusts, most certainly in legal jargon and cleverly worded sentences so as to avoid the full disclosure of any land held in England particularly under their antiquated system of concealed land registry. A sceptic would believe it was a deliberate ploy but who are we to question the advice given by lawyers or to the law of the land?

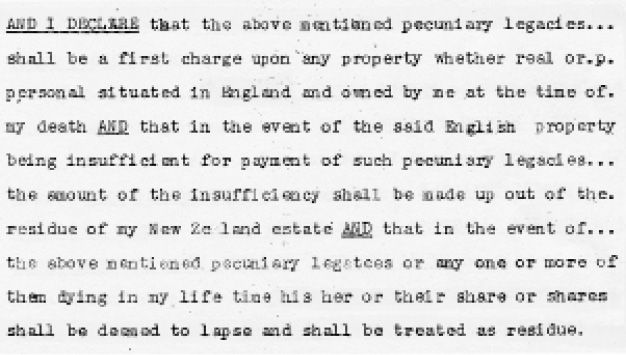

And, yes I believe it was deliberate as only one document has been discovered to date that specifically mentions properties in England. The references were found in clauses 3 & 9 of the Last Will and Testament of Newman Chennells dated 24 June 1938 where it specifically says “. . . of the said English property . . .” (the full context is panelled below).

This complete section needed further scrutiny as some comment on other phrases mentioned by Newman is warranted. For example “pecuniary legacies” could be interpreted as termed investments in land, shares or insurance policies and it is quite important to note this as they strongly figure in decisions that will be made over the next four decades.

Another connecting phrase that opened a can of worms as a possible motive for murder is also mentioned in this statement of settlement: “. . . that in the event of the above mentioned pecuniary legatees or any one or more of them dying in my life time his her or their share or shares shall be deemed to lapse and shall be treated as residue.”

What Newman is actually saying is if any of his beneficiaries should die before him, they are immediately crossed off the list for any gains to his estate. In other words they cease to be a beneficiary of his estate which means their descendants do not inherit. As a result this “residue” is divided accordingly amongst the surviving beneficiaries. This could potentially add up to quite a large amount some time in the future.

HOW WILLS FIT IN WITH FAMILY TRUSTS

On top of all this I have found it quite confusing at times to separate my thoughts when dealing with how a family trust fits in with a will. My understanding is that the will does not deal with the assets held in the trust as a person’s will basically says what will happen to their personal assets and it has no control over family trust assets.

Readers should hold the understanding that assets in a family trust are owned and controlled by the trustees and a will cannot dictate to the trustees what will happen to those assets.

It is very important to appoint trustworthy people and this is normally done through your will and while they have the discretion to act wisely, they will most likely abide by your wishes. The Chennells did this well by keeping it within close family circles with, I believe, the exception of family lawyer Colin Sturrock and special trustee Alf Hodgson. These two names will become familiar as the plot unfolds.

MILLION DOLLAR QUESTION

With foresight one could easily raise the million dollar question right now: How many people would have gained from Maisie Demler’s estate if Jeannette Crewe had NOT been murdered?

The obvious answer is that Jeannette, as basically the sole beneficiary, had everything to gain had she legally inherited her mother’s estate with the interest of a multitude of others, who are not named at this stage, becoming losers in one way or another. Therein lies the real possibility of a motive, identified but under estimated by most.

It is going to take the best part of this book to explain who could be included on my list–some will deserve to be named while others may not have been aware of the consequences of the 1970 double murder.

Earlier I thought getting proof was vital for getting to the bottom of this murder mystery and while I do not have all the facts I really wanted, I intend to carry on with what I know and let the reader decide whether my research will carry enough facts to make sense.

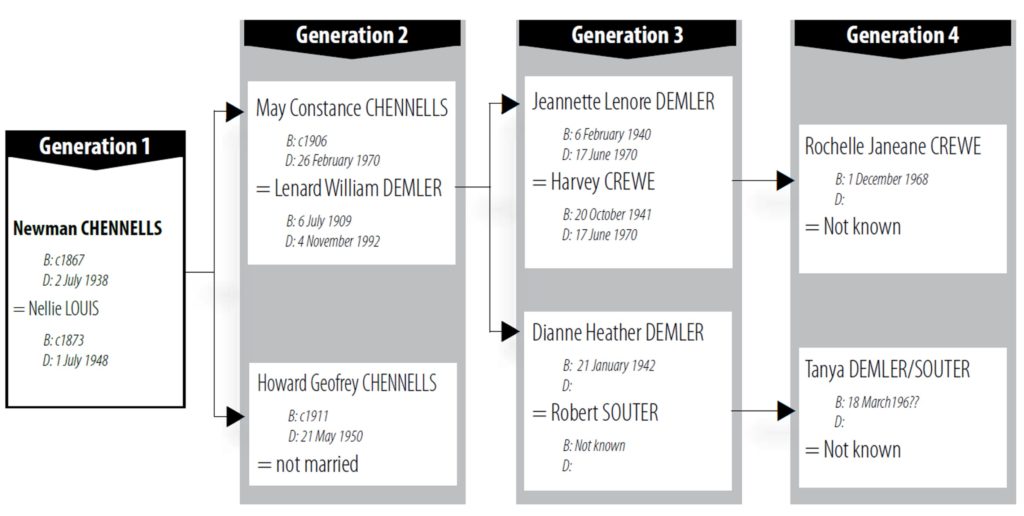

ABOUT NEWMAN AND NELLIE

First some background on Newman and Nellie Chennells. Newman’s name was found on the 1901 Census for England where he was listed as an auctioneer. His age was entered as 34 with estimated birth being 1867.

His spouse was given as Nellie Chennells and both were living in the County of Sussex but finding information about their early life in New Zealand has been equally frustrating.

More detail will come later but their settling place was in the Auckland area. Newman’s name appears on the Auckland West electoral roll of 1911 and his address was listed as 11 Tole St which is off Ponsonby Road and his occupation was land agent.

COURT ACTION AGAINST NEWMAN

My research shows that Newman was involved with court action for damages and specific performance of a contract in 1912. More appearances also in 1917 and 1920 with claims for commission not being paid.

The first case mentioned was in December 1912 while Newman Chennells was carrying out his role as a Land Agent in a sale of a property at Swanson, north-west of Auckland.

In giving his judgment, His Honour remarked that the facts concerning this case were “peculiar” and gave the following details as reported in the Auckland Star: “Early in the year defendant had placed his property in an agent’s hands (Newman Chennells) for sale with a reserve in the event of an increase in value through increased railway service.

“The judge commented on the unsatisfactory manner in which the agent had given his evidence, and stated that in his opinion the agent was aware of the intention of the Minister of Railways to increase the suburban railway service, and knew that defendant’s property would, therefore, be considerably increased in value.

“He referred also to the manner in which the agent had hurried through the deal, and in which he had concealed the fact that his client was not a resident in New Zealand. Had the facts been known the suspicions of the defendant would assuredly have been aroused. The contract therefore would not be enforced.”

CLAIMS FOR COMMISSION

A second case, in a claim for commission in 1917 by Newman Chennells (reported as trading as Chennells & Co, Land Agent, Queen St, Auckland) could not be proved through a failure of not having his “appointment to act” in writing as required by section 13 of the Land Agents Act, 1912. A similar situation involving Chennells also occurred in 1920.

The authority required by the Act must be signed by the owner of the land with the signature of the agent not being sufficient. Chennells lost both cases because of his failure to dot the i’s and cross the t’s.

These dealings are being mentioned now because I believe the extent of this man’s talents in wheeling and dealing of property over two or three decades will come to the fore as a family trait as this story unfolds.

The thought sticks in my mind that Newman Chennells had a wonderfully useful mix of professions as a real estate agent, auctioneer and farmer. If he had the gift of the gab, which I believe he did, then he could easily match up a deal using his auctioneering skills and salesmanship.

These actions could possibly be classed as a form of insider trading so hold onto this thought until more is revealed in later years as he applied these skills when times got tough throughout the 1920s and 1930s.

Think about this. The auctioneer/land agent on any sale would probably know just how much money it would take to defer a bank mortgage then settle by deed of arrangement, a document that would have conditions for settlement at a later date.

UNDERSTANDING HOW IT WORKS

On reading and trying to understand the legalese wording used in the various wills encountered during this research has given me many sleepless nights. There are many clauses as to the management and control over rents and leases of farms that tests the mind. The way I have come to see it, as a layman (when an estate is divided up so that it can be handed down through the families) is often skipped over without fully realising its intent

This was how I learnt about secret trusts (fully secret and half secret) and it was not until I read Nicky Richardson’s book Nevill’s Law of Trusts, Wills and Administration that I found enough clues to understand what may have caused a double murder.

At this stage I cannot say categorically that it did but I am offering the distinct possibility that it was in the mix of variations and I mention it now as part of the big picture so that the reader can consider all possibilities when assessing where the truth really lies.

Secret trusts occasionally happen when a will-maker desires to make certain provisions take effect after death which he (or she) is reluctant to disclose to a solicitor or to the public records of the probate registry.

Nicky writes that the will-maker may wish to effect some unlawful purpose, such as an act of private vengeance of a criminal nature. Of course the will-maker may just wish to be benevolent.

“With fully secret trusts, no trust appears on the face of the will but it will have been communicated to the secret trustee so that he or she is bound by it. In the latter case, the secret trustee takes the property as trustee on the face of the will although the trusts on which he or she holds the property are secret.”

There is a lot more detail outlining variations to the concept of secret trusts as is with half secret trusts.

“If a gift is stated to be on trust but the trusts are not expressed in the will, a half-secret trust is said to exist. In such a case, certain different considerations operate from those discussed in connection with fully secret trusts.

“The person taking the gift does not take beneficially, but must hold it on the ‘secret’ trusts if lawful, or on trust for the residuary beneficiary or the next of kin.”

What all this means, in its simplest terms, is that Newman Chennells was able to name a “special trustee” in his will so that if wanted he could include a fully secret trust for his English estate.

Secret and half secret trusts were used in Britain historically and to some extent in New Zealand although they are rare today. This method was to be used by many succeeding family members over the following decades which in turn kept all family legacies intact until that fateful day in 1970.

Leave a Reply